The IRS estimated the annual tax gap of what was owed and what was collected as, “…the annual tax gap for 2008-2010 is estimated to be $458 billion, compared to $450 billion for tax year 2006.” We know that the Cebula-Feige estimate of tax evasion for the same period is $600 billion. These numbers can no longer be ignored by the Congressional leaders promoting tax reform, but they are still in denial about how to fix the problem.

As Fran Tarkenton, the great Minnesota Vikings quarterback, said, “Ignoring facts does not make them go away.” Congressional leaders must not ignore either the existing tax evasion situation, or the fact that it is going to increase in the next few years. The rapidly changing character of our U.S. workforce means that fewer people will be employees and subject to withholding and that, historically, people not subject to withholding will have much higher rates of evasion. Why?

Because taxes are not withheld before they receive their income, people not subject to withholding will receive 100% of their money. Then they calculate their taxable income and pay “their money” to the U.S. Treasury. Obviously, if they decide to “not report” some cash income or take some “exaggerated” deductions, they will be able to keep more of the money they received. Since there seems to be no public outcry against people who “falsify” their income, it is becoming more and more common.

If the income/payroll tax system will have higher levels of evasion in future years, why do these Congressional leaders cling to only making changes to the existing system? The answer is that the existing system works for them—if not for everyone else. However, they can’t say this so they rely on the false proposition that it is only necessary to lower the income tax rates and make filing returns simpler to reduce tax evasion. While there is some evidence that if all the tax rates were lowered that there would be less evasion, it is demonstrably not correct if only federal income tax rates are lowered.

Although this excerpt from an International Monetary Fund study is used to defend their actions, it is important to note the part that we have put in bold that is ignored by the Congressional leaders.

"Macroeconomic and microeconomic modeling studies based on data for several countries suggest that the major driving forces behind the size and growth of the shadow economy are an increasing burden of tax and social security payments… The bigger the difference between the total cost of labor in the official economy and the after-tax earnings from work, the greater the incentive for employers and employees to avoid this difference and participate in the shadow economy. …Several studies have found strong evidence that the tax regime influences the shadow economy."

Here Are The True Facts

Tax evasion is not done just by people who operate illegal businesses or mobsters. It is mostly done by people who are reporting income but who have found a way to not report cash they receive and/or people who exaggerate or even create deductions from taxable income. For example, instead of deducting the portion of their home that is their home-office, some will deduct the entire cost of the house as business rent. Others deduct all of their food and all of their families' cell phone expenses—even though they are not business related.

There are many other examples but not reporting cash and each of these fictitious or exaggerated deductions reduce the amount of taxable income that is subject to federal income/payroll taxes and state income taxes.

A person who is self-employed subtracts his/her business expenses from gross income to arrive at the amount of taxable income. Payments for Social Security and Medicare taxes are a percentage of this taxable income amount. State income taxes are also a percentage of this taxable amount.

If someone is going to reduce the amount of taxable income by either not reporting cash payments or by exaggerating or inventing deductions, they are not only evading federal income taxes but also Social Security/Medicare taxes and state income taxes. Most state income tax returns are based on the federal income tax return. This can be demonstrated by the example below of Jack the Plumber.

Jack operates his plumbing business as a sole proprietor and reports his income and expenses on Schedule C of his 1040 income tax return. Jack also pays 15.3% of the net income from his plumbing business for Social Security/Medicare taxes, and we assume the average state income tax rate of 5%. He is married and files a joint federal income tax return.

In the first example, Jack correctly reports his income and takes only proper deductions and has a net taxable income of $80,000. Below is an example of the taxes he will owe.

Taxable Income $80,000

Federal Income tax 11,549

Social Security & Medicare taxes 12,240

State income tax 4,000

Total Taxes $27,789

Combined Tax Rate 35%

In the second example, Jack doesn't report all the cash he receives and takes improper deductions and only reports taxable income of $60,000, reducing his combined tax rate from 35 to 25% Below is an example of the taxes he will owe.

Taxable Income $60,000

Federal Income tax 6,067

Social Security & Medicare Taxes 9,180

State Income Tax 3,000

Total Taxes $20,256

Combined Tax Rate 25%

By improperly reducing his taxable income by $20,000, Jack has an additional $7,533 available for his consumption. ($27,789 - $20,256 = $7,533)

If Congress passes legislation that reduces Jack's federal income tax rate by 25%, then Jack's tax calculation would be the following :

Taxable Income $80,000

Federal Income tax 8,661

Social Security & Medicare taxes 12,240

State income tax 4,000

Total Taxes $24,901

Combined Tax Rate 31%

In the second example, Jack doesn't report all the cash he receives and takes improper deductions and only reports taxable income of $60,000, reducing his combined tax rate from 31% to 28% Below is an example of the taxes he will owe.

Taxable Income $60,000

Federal Income tax 4,550

Social Security & Medicare taxes 9,180

State Income Tax 3,000

Total Taxes $16,730

Combined Tax Rate 28%

What Will Make Jack Stop Evading

Presently, Jack knows that his chances of being audited are less than 1%. He also knows that since he is reporting a substantial portion of his income, even if he is audited the chances of his evasion being caught are not assured. Finally, Jack knows that even if his evasion is discovered, it is almost 100% certain that the only punishment will be to pay the evaded taxes along with interest and some penalties.

Our question to the Congressional leaders is why will Jack suddenly start paying his actual taxes? He has already made the decision that it is ok to cheat.

Conclusion

Is it possible to reduce income/payroll tax evasion? It certainly would have an impact on a person’s decision to evade if Congress:

- Passed legislation to dramatically increase criminal prosecutions for income tax evasion

- Imprisoned 50,000 to 100,000 people each year instead of 2,000

- Authorized the hiring of tens of thousands of new IRS auditors and insisted that they conduct extensive audits requiring verification of every deduction

- Increased dramatically the penalties and interest imposed on anyone found to owe taxes by these IRS auditors

The Congressional leaders that are ignoring the facts that their "reforms" to the present income/payroll tax system will not lead to lower amounts of evasion should remember the words of Abraham Lincoln who said "You cannot escape the responsibility of tomorrow by evading it today.

YOUR CHANCE TO BRING ABOUT REAL TAX REFORM

Abraham Lincoln also said, “Things may come to those who wait, but only the things left by those who hustle.”

We may only have a limited time to stop the fake tax reform being promoted by some in Congress. If it passes, then the Elites will say that we need to wait before we consider any more changes. To stop this fake reform, we must be able to ensure that our message is clearly heard not only by Congress but also by President-elect Trump. To do this we need your help.

By contributing (investing) $10.40 per month, you help provide a financial base to AFFT. If you can make larger contributions (investments), these will be used not for salaries, as we are all volunteers, but for the needed updates to our economic studies which will be vital in 2017.

Please go to this link to invest in AFFT and in your and your family’s future.

FAIRtax E-Book

You have to start somewhere. If someone needs to start from the beginning with the FAIRtax, this e-book is what they need. We all need to become engaged in order to force Congress and President Trump to adopt the FAIRtax as the new tax plan. We all need to come up to speed on the FAIRtax. This e-book is the first step.

AMERICA'S BIG SOLUTION is available for only $2.99 for the Amazon Kindle, the Barnes & Noble Nook and Apple iOS.

AMERICA'S BIG SOLUTION by Florida Volunteer Terry Tibbetts has been written to give people of all ages a basic introduction to the FAIRtax and encourage them to learn more about the most thoroughly researched tax plan ever presented to Congress. It is a light hearted approach to a very serious subject.

Everyone needs to know that we have an alternative to federal income tax and the criminal enterprise known as the IRS. Everyone needs hope and AMERICA'S BIG SOLUTION provides that hope. AMERICA'S BIG SOLUTION is an alternative the social media platforms competing for our attention.

You can even purchase a print copy at the same Amazon link above for $9.25. Regardless of whether you choose the electronic format or the print format, you'll find AMERICA'S BIG SOLUTION will give someone the boost they need to begin their study of the FAIRtax and the suggested resources to learn more. Buy AMERICA'S BIG SOLUTION now!

AFFT National LOGO Store

THE FAIRTAX® LOGO STORE

SUPPLYING EDUCATIONAL/PROMOTIONAL ITEMS

New Arrival

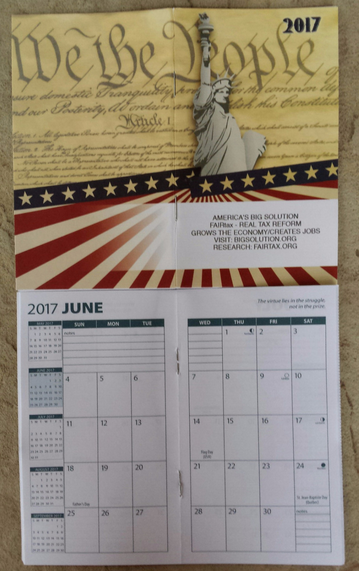

2017 America’s Big Solution Pocket Calendars

THE TIME TO GIVEAWAY A FAIRTAX PLANNER IS NOW !!! WHEN SUPPORTERS START TO USE OUR PLANNER, IT BECOMES THEIR GO-TO CALENDAR FOR THE REST OF THE YEAR CONTINUOUSLY REMINDING THEM OF THE FAIRTAX.

The 2017 FAIRtax℠ monthly pocket/purse planner has the following information on the cover:

AMERICA’S BIG SOLUTION

FAIRtax – REAL TAX REFORM

GROWS THE ECONOMY/CREATES JOBS

VISIT: BIGSOLUTION.ORG

RESEARCH: FAIRTAX.ORG

Record your event dates per month. Also includes space for personal info plus holiday dates, time zones, metric conversion charts and a 5” ruler. Size 3.5’ x 6”. Great for giveaways. We are offering these new 2017 pocket planners at 10 units per dollar. We only have 2,000 units in inventory, so get your supplies soonest. Order as many packs as you need.

WE CONTINUE TO OFFER OUTSTANDING STORE BOGO’S

PLUS 25% DISCOUNT ON ALL BANNERS

COMING SOON **** FAIRtax℠ Vehicle SUNSHADES **** Don’t miss this one!!!!

When visiting the Store, don’t forget to order a supply of FAIRtax℠ Palm Cards AND the new FAIRtax Informational Business Card. Besides handing out palm cards and info Business Cards at meetings and events, whenever you send mail through the post office, including a few FAIRtax℠ informational Palm Cards and Business Cards in your envelope. And don’t forget some FAIRtax stickers for the outside of your postal envelopes – all are available at the your FAIRtax Store.

Please take a moment and visit our store by clicking here.

FAIRtax Power Radio

Through the "Hope and Change" of the last eight years and the promises to "Make America Great Again," what is Congress and the new administration offering us as tax reform? At this point, both President Trump and the Speaker Ryan are offering a modification of the current failed system. As Kerry Bowers, one of The FAIRtax Guys interviewees, said about Speaker Ryan's "A Better Way" plan, "It transforms the tax plan from a personal income tax, a corporate income tax and a payroll tax enforced and administered by the IRS to a system that includes a personal income tax, a corporate income tax and a payroll tax enforced and administered by the IRS." Is this the best way?

As The FAIRtax Guys discuss in their weekly podcasts, this plan does not represent "Hope and Change" and is not the way to "Make America Great Again." We need true tax reform; we need the FAIRtax. And we provide the listener new and novel ways to discuss the FAIRtax with your friends and neighbors every week.

You can listen to our FREE podcasts on Spreaker, iTunes and iHeart Radio. You can listen on line or download the podcasts to your computer or smartphone.

And for your iPhone or Android, we have the free FAIRtax Power Radio app. Just search for FAIRtax Power Radio in your app store, download the app and start listening. We post a new episode every Friday morning. Please listen in and tell everyone you know about the FAIRtax Power Radio podcasts.

Links for Further Information

Please, if you'd like to keep studying and promoting the FAIRtax, make yourself familiar with the links below. We always do our best to keep our AFFT community up to date, and you can stay ahead of the curve using these convenient sites.

- The website of Americans for Fair Taxation

- The FAIRtax website at which you can get involved to help make it happen.

- The Facebook page for Americans for Fair Taxation

- The Facebook page for The FAIRtax Guys

- The Twitter page for Americans for Fair Taxation

- PopVox - Connecting people and lawmakers for more effective participation and better governing

- YouTube channel for AFFT

- Provides FAIRtax promotional materials with authorized AFFT logos.

- Do your shopping, save money and support the AFFT

Thank You For Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure that AFFT is paid ever larger amounts from people paying for us to send their offers to our supporters.

Again, we are making every effort to ensure that we work with only reputable companies. If you feel that any FAIRtax-sponsored email is objectionable, please email us at info@fairtax.org and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!