Albert Camus, the 20th century French philosopher, was asked about how things that were started with good intentions actually became harmful. Camus said, “The evil that is in the world almost always comes of ignorance, and good intentions may do as much harm as malevolence if they lack understanding.”

The 16th Amendment, allowing an income tax, was ratified in 1913 and the 18th Amendment, prohibiting the production and sale of alcohol in the United States, was ratified in 1917. Both of these amendments were advocated by people with what they believed were the best of intentions.

The advocates for the 16th Amendment promised that the wealthy would no longer escape supporting the country but would now have to pay their “fair” share. They also promised that most of the rest of us would not have to pay the income tax because this was only for the wealthy.

The advocates of the 18th Amendment promised that banning the production and sale of alcohol would remove from society the harmful effects of alcohol. Since alcohol was responsible for many problems, this would be good for people.

Similarities

The 18th Amendment required enforcement. Congress passed the Volstead Act which created a special unit of the Treasury Department to enforce the prohibition. This was vetoed by President Wilson but passed over his veto. We know from history that prohibition was a disaster. Not only was it widely ignored but it created huge criminal enterprises.

Perhaps more importantly, it created an environment where more and more people condoned illegal behavior, either by purchasing alcohol or by not reporting to the authorities or complaining about alcohol sales known to them. These activities of “looking the other way” were largely done because more and more people made the decision that it was a “bad” law and didn’t need to be obeyed. While a majority of Americans did not themselves drink alcohol, they condoned the violation of the law by their neighbors. Most Americans, if asked during prohibition where someone could obtain a drink of alcohol, could refer them to one or more sources. However, these same Americans did not report these sources of alcohol to the police.

The 16th Amendment also required the enactment of legislation setting out the actual income tax and how it was to be enforced. Congress has succeeded in making the income tax almost incomprehensible. The IRS has been given power that it has used, often irresponsibly, and has become a detested agency. Enforcing the income tax code is a thankless job and is becoming more and more problematical.

As was true with Prohibition, the majority of American taxpayers obey the income tax laws. Employees, about 65% of the income tax payers, have little choice since their income/payroll taxes are withheld before they receive their checks. Many of the other non-employee income tax payors pay their income taxes.

Almost all American taxpayers can point to individuals offering services at large discounts for cash. Although they may not have actual proof that these individuals are not reporting their income for tax purposes, many believe that this is the only reason for the large cash discount. However, even the ones who themselves do not pay cash for these discounts almost never report these cash acceptors—even though the IRS will pay them as much as 30% of the unpaid taxes collected.

Moral Consequences And Theft

Aldous Huxley, the author of Brave New World, said, “Hell isn't merely paved with good intentions; it's walled and roofed with them. Yes, and furnished too.”

People who illegally avoid paying their share of income/payroll tax are forcing the rest of us to pay their share of the costs of government. If the estimated $600 billion of evaded income/payroll taxes were paid, there would be no budget deficit this year.

In 1991, I was asked to speak at a conference in Denver where 500 people who actively wanted to eliminate the income tax were gathering from around the country. It was only when I arrived that I learned that the attendees were largely tax protestors. My wife and I had a booth and a petition that few signed. When we asked why, we were told that they agreed with us but were convicted felons and could not vote.

My proposal to replace the income tax with a retail sales tax was attacked by one huge man with an enormous beard. He looked like an Old Testament prophet. He said that I was feeding the beast and should be condemned. There was loud applause.

When I had the chance to respond, I said that I was certain he was a sincere man and would certainly not do anything to take advantage of others. The man nodded his head in agreement. Then I said that I was also certain that he did not use the services for which he did not pay his share of the costs.

I then stated that I was sure that he did not receive mail through the post office because it was largely funded by the income taxes others paid and he didn’t. I was also sure that he didn’t drive on federal highways because there were largely paid for and maintained by the income taxes he refused to pay.

It looked like he was going to attack me, but the audience did the cruelest thing from his point of view when they started laughing at him. This seemed to take the aggressiveness out of him and he stormed off the stage.

Conclusion

Regardless of all the justifications given by people who evade payment of legally owed income/payroll taxes, it is a crime. The law plainly requires these payments. Also, it is not a “victimless” crime. The rest of us who do try to obey the income/payroll tax laws are the ones from whom these evaders are “stealing.” The government is just the people. If you steal from the government you steal from the people.

Every dollar evaded must be raised by collection of taxes from the rest of us or by incurring more debt. It takes money to provide government services. Some of the people who most attack welfare payments are the same people who think it is OK for them to either illegally evade taxes or assist others to do so by taking advantage of large cash discounts with the almost certain knowledge that the recipient will not report the cash as income.

Some say that this is just civil disobedience in the tradition of Martin Luther King. However, Martin Luther King did not advocate the breaking of laws for personal gain. Dr. King said, “An individual who breaks a law that conscience tells him is unjust, and who willingly accepts the penalty of imprisonment in order to arouse the conscience of the community over its injustice, is in reality expressing the highest respect for the law.”

The tax protestors who willingly go to prison to protest the tax laws are in one category, but the income/payroll tax evaders who are very careful to disguise their “theft” are in a different category.

If both groups really want to eliminate the income tax system, they should join us and help replace the income tax/payroll tax system with the FAIRtax. Making us pay for the services they use but refuse to pay for is wrong.

The 18th Amendment was repealed by the 21st Amendment which was ratified on December 5, 1933. It is time for the 16th Amendment to be repealed and for the U.S. to adopt a national retail sales tax, the FAIRtax, to fund our government.

THE ELITES AND TAX REFORM

There is continued clamor for tax reform in the first part of 2017. There is also a continuing stream of releases from D.C. that promise that now they will “fix” the broken income tax system. Of course, their idea of a “fix” is to keep the same structure in place so that they can profit from selling exceptions in future years.

Americans For Fair Taxation “(AFFT”) is one of the few worthy activities that does not spend your funds on salaries or even office space. It is a group composed of people who are donating their time and even paying their own expenses.

AFFT has been working for a long time to educate people about the FAIRtax. Oscar Wilde said, "You can always judge a man by the quality of his enemies." If you agree with this sentiment, then look at the enemies of the AFFT. It is not the people. It is the D.C. elites who profit from the existing income tax/payroll tax system—even though it is obviously harming the U.S.

By contributing (investing) $10.40 per month, you help provide a financial base to AFFT. If you can make larger contributions (investments) these will be used not for salaries, as we are all volunteers, but for the needed updates to our economic studies which will be vital in 2017.

Please go to this link to invest in AFFT and in your and your family’s future.

New FAIRtax Book

AMERICA’S BIG SOLUTION - An Introduction to the FAIRtax

You can help introduce someone to the FAIRtax by informing them of this book. As the title indicates, it is an introduction to the FAIRtax and is directed toward people who may have heard of the FAIRtax but are not really sure of just what it is. Written by Florida volunteer Terry Tibbetts, the book offers a light hearted approach to a serious subject, reforming the federal tax system. America’s Big Solution gives the reader enough information to get them started in their examination of the most thoroughly researched tax reform proposal our country has ever seen. “ABS” is intended for people who may not be attracted to social media for all the latest news and would like to gather their information in a more traditional form that is not limited to a 140 character “tweet” or a Facebook post.

You can find America’s Big Solution on the three most popular platforms -- Amazon, Barnes & Noble and the Apple iBook Store. To purchase the electronic form for the Amazon Kindle or the print form, go to this website. To find it for your Barnes & Noble Nook, go here. And if you’re an Apple user, go to the iBook store at this site. The print version (only available at Amazon) is $9.25 whereas the electronic versions are all priced at $2.99. (Apparently electrons are less expensive than paper and ink!) All royalties go to Americans For Fair Taxation.

Please share this information with everyone you know. The more people know about the FAIRtax, the easier it will be to steer Congress into the only REAL tax reform proposal on the table at this time.

AFFT National LOGO Store

THE FAIRTAX® LOGO STORE

SUPPLYING EDUCATIONAL/PROMOTIONAL ITEMS

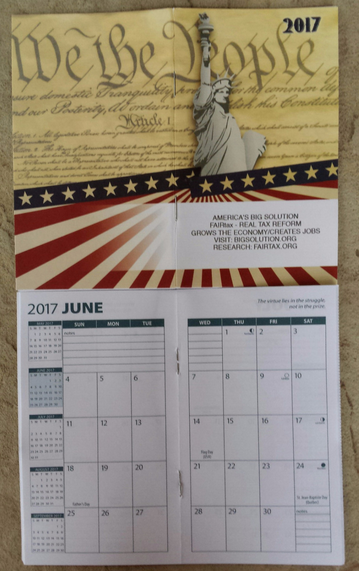

2017 America’s Big Solution Pocket Calendars

THE TIME TO GIVEAWAY A FAIRTAX PLANNER IS NOW !!! WHEN SUPPORTERS START TO USE OUR PLANNER, IT BECOMES THERE GO-TO CALENDAR FOR THE REST OF THE YEAR CONTINUOSLY REMINDING THEM OF THE FAIRTAX.

The 2017 FAIRtax℠ monthly pocket/purse planner has the following information on the cover:

AMERICA’S BIG SOLUTION

FAIRtax – REAL TAX REFORM

GROWS THE ECONOMY/CREATES JOBS

VISIT: BIGSOLUTION.ORG

RESEARCH: FAIRTAX.ORG

We are offering these new 2017 pocket planners in packs of 10 units for one dollar. Order as many packs as you need; 45% of our limited inventory sold out the first week. Don’t be disappointed, order your supply now!

Please take a moment and visit our store by clicking here.

FAIRtax Power Radio

Just in time for Christmas, FAIRtax Power Radio has a gift for all our listeners that use smartphones. FAIRtax Power Radio has its own free app for the iPhone and the Android. Just go to your respective app store, search for “fairtax power radio” and you’ll see the app. After you download it, open it and you’ll be presented with all the episodes of FTPR. Just tap the episode you want to listen to and enjoy. It is the simplest way to keep up with our weekly episodes. And it is completely free to the listener.

Please tell all your friends and family about our new app. FTPR is one of the best ways to keep abreast of the developments in our efforts to make the FAIRtax the law of the land. It’s way past time that we eliminate the income tax and relegate it to the scrap heap of history. It was a bad idea 103 years ago, it’s a bad idea now and we deserve better.

If you believe, as we do, that the FAIRtax is the only REAL tax reform in Congress, then you can help us spread the word to millions of our fellow citizens by asking them to download the free app and listen to our weekly podcasts. It’s time to become part of the solution!

Finally, The FAIRtax Guys will hold our first Facebook Live event on Tuesday December 20th at 8 PM ET. If you are a Facebook user, all you need to do is go to our Facebook page at the designated time on the 20th and you’ll see “The men behind the mustaches.” This first Live event will be relatively short - about 15 minutes. In January, we will have another Live event of longer duration. We will also set up a system in which you can send comments and questions and we will do our best to respond during the event. So mark you calendar: 8 PM on 12/20. Ho Ho Ho!

Links for Further Information

Please, if you'd like to keep studying and promoting the FAIRtax, make yourself familiar with the links below. We always do our best to keep our AFFT community up to date, and you can stay ahead of the curve using these convenient sites.

- The website of Americans for Fair Taxation

- The FAIRtax website at which you can get involved to help make it happen.

- The Facebook page for Americans for Fair Taxation

- The Facebook page for The FAIRtax Guys

- The Twitter page for Americans for Fair Taxation

- PopVox - Connecting people and lawmakers for more effective participation and better governing

- YouTube channel for AFFT

- Provides FAIRtax promotional materials with authorized AFFT logos.

- Do your shopping, save money and support the AFFT

Thank You For Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure that AFFT is paid ever larger amounts from people paying for us to send their offers to our supporters.

Again, we are making every effort to ensure that we work with only reputable companies. If you feel that any FAIRtax-sponsored email is objectionable, please email us at info@fairtax.org and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!