COSTS OF TAX EVASION TO U.S. HOUSEHOLDS

Many of us have been offered opportunities to save on the price of services if we paid in cash. The people offering these discounted services often readily admit, or even boast, that they are able to offer this reduced price because they are not going to report the money they receive as income. This means that they will not pay Social Security, Medicare and income taxes on the money they receive.

More and more people are accepting these offers. Generally, the savings are relatively small but in some cases the savings can be hundreds or even thousands of dollars. Under the present income/payroll tax system, there is nothing illegal associated with paying cash to anyone. It is up to the person receiving the cash to report the income in the same way it would be reported if it were a credit card payment or check. Of course, if you know the person is not going to report the income for sure, then you are a co-conspirator to tax evasion under the U.S. Criminal Code and liable to prosecution.

The National Tax Research Committee (“NTRC”) is a non-profit corporation that funds research on federal taxation. Their most recent study is entitled Estimated Future Lost Tax Revenues to the IRS under the Income Tax and Prospects for Tax Evasion under the FairTax: New Perspectives by Richard J. Cebula, Ph.D., Walker/Wells Fargo Endowed Chair in Finance, Jacksonville University (FL) and Fiorentina Angjellari-Dajci, Ph.D., Florida State College at Jacksonville, Florida.

Last week we pointed out that the study showed that the income/payroll tax evasion amount will likely be $9 trillion over the next ten years. Also, this study on federal tax evasion was to examine not only evasion but who pays for it. According to Nina Olson, The National Taxpayer Advocate, dividing the Total Tax Gap by the number of households gives a measure of the annual “surtax” being assessed on the average household to enable the federal government to raise the same level of revenue it would collect if all taxpayers were to report their income and pay their taxes in full. This so-called “surtax” amounts to a shift of the tax burden from households who don’t pay their taxes to the households that do. The chart below shows average tax burden shift for American households as evasion escalates during the next decade. In 2017, the average U.S. household will need to pay an additional $5,365 in federal taxes to offset the evasion of those taxes. This number will grow to $8,526 by 2026 according to this study. Clearly this chart shows that each time someone evades their federal taxes, it directly impacts the rest of us who are paying the costs of our government.

Conclusion

Your Members of Congress should be sent the above table. Ask them to explain how they are going to address the issue of federal tax evasion and prevent honest Americans from having to carry the burden of evasion that will be a total of $9 trillion in the next ten years. Once the NTRC has released the entire evasion study, we will be making it available for you to send to your Members of Congress.

We should ask these Members to explain if they are going to support the hiring of tens of thousands of new IRS auditors and dramatically increase penalties necessary to reduce tax evasion.

DON’T MISS YOUR CHANCE TO HELP BRING ABOUT REAL TAX REFORM

Abraham Lincoln also said, “Things may come to those who wait, but only the things left by those who hustle.”

We may only have a limited time to stop the fake tax reform being promoted by some in Congress. If it passes, then the Elites will say that we need to wait before we consider any more changes. To stop this fake reform, we must be able to ensure that our message is clearly heard not only by Congress but also by President-elect Trump. To do this we need your help.

By contributing (investing) $10.40 per month, you help provide a financial base to AFFT. If you can make larger contributions (investments), these will be used not for salaries, as we are all volunteers, but for the needed updates to our economic studies which will be vital in 2017.

Please go to this link to invest in AFFT and in your and your family’s future.

FAIRtax E-Book

AMERICA’S BIG SOLUTION - An E-book For Beginners

You have to start somewhere. If someone needs to start from the beginning with the FAIRtax, this e-book is what they need. We all need to become engaged in order to force Congress and President Trump to adopt the FAIRtax as the new tax plan. We all need to come up to speed on the FAIRtax. This e-book is the first step.

AMERICA'S BIG SOLUTION is available for only $2.99 for the Amazon Kindle, the Barnes & Noble Nook and Apple iOS.

AMERICA'S BIG SOLUTION by Florida Volunteer Terry Tibbetts has been written to give people of all ages a basic introduction to the FAIRtax and encourage them to learn more about the most thoroughly researched tax plan ever presented to Congress. It is a light hearted approach to a very serious subject.

Everyone needs to know that we have an alternative to federal income tax and the criminal enterprise known as the IRS. Everyone needs hope and AMERICA'S BIG SOLUTION provides that hope. AMERICA'S BIG SOLUTION is an alternative the social media platforms competing for our attention.

You can even purchase a print copy at the same Amazon link above for $9.25. Regardless of whether you choose the electronic format or the print format, you'll find AMERICA'S BIG SOLUTION will give someone the boost they need to begin their study of the FAIRtax and the suggested resources to learn more. Buy AMERICA'S BIG SOLUTION now!

FAIRtax Power Radio

Weekly Podcasts and Monthly Facebook LIVE

The FAIRtax Guys do a free weekly podcast just for you. Though the “Hope and Change” of the last eight years and the promises to “Make America Great Again,” what is Congress and the new administration offering us as tax reform? At this point, both President Trump and the Speaker Ryan are offering a modification of the current failed system. As Kerry Bowers, one of The FAIRtax Guys interviewees, said about Speaker Ryan’s “A Better Way” plan, “It transforms the tax plan from a personal income tax, a corporate income tax and a payroll tax enforced and administered by the IRS to a system that includes a personal income tax, a corporate income tax and a payroll tax enforced and administered by the IRS.” Is this REAL reform? No!

As The FAIRtax Guys discuss in their weekly podcasts, this plan does not represent “Hope and Change” and is not the way to “Make America Great Again.” We need true tax reform; we need the FAIRtax. And we provide the listener new and novel ways to discuss the FAIRtax with your friends and neighbors every week.

You can listen to our FREE podcasts on Spreaker.com, iTunes or iHeart Radio. You can listen on line or download the podcasts to your computer or smartphone.

And for your iPhone or Android, we have the free FAIRtax Power Radio app. Just search for FAIRtax Power Radio in your app store, download the app and start listening. We post a new episode every Friday morning. Please listen in and tell everyone you know about the FAIRtax Power Radio podcasts.

The next Facebook LIVE event for FAIRtax Power Radio will be held Monday, March 6 at 8 PM ET. It’s also free and it’s LIVE so you can interact with us and get an immediate response. In fact, you can become part of the event. The February LIVE event was quite successful and this one well be even better. Keep tuned for more in and checkout our Facebook page: https://www.facebook.com/thefairtaxguys/

Links for Further Information

Please, if you'd like to keep studying and promoting the FAIRtax, make yourself familiar with the links below. We always do our best to keep our AFFT community up to date, and you can stay ahead of the curve using these convenient sites.

- The website of Americans for Fair Taxation

- The FAIRtax website at which you can get involved to help make it happen.

- The Facebook page for Americans for Fair Taxation

- The Facebook page for The FAIRtax Guys

- The Twitter page for Americans for Fair Taxation

- PopVox - Connecting people and lawmakers for more effective participation and better governing

- YouTube channel for AFFT

- Provides FAIRtax promotional materials with authorized AFFT logos.

- Do your shopping, save money and support the AFFT

AFFT National LOGO Store

THE FAIRTAX® LOGO STORE

SUPPLYING EDUCATIONAL/PROMOTIONAL ITEMS

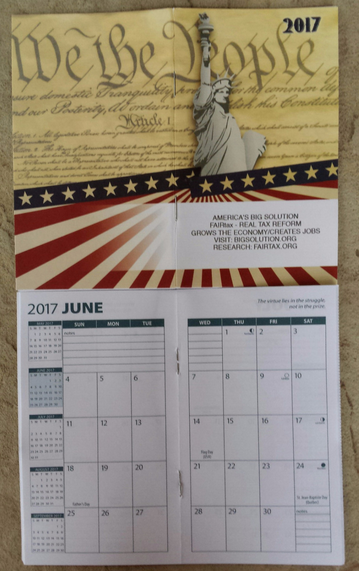

2017 America’s Big Solution Pocket Calendars

THE TIME TO GIVEAWAY A FAIRTAX PLANNER IS NOW !!! WHEN SUPPORTERS START TO USE OUR PLANNER, IT BECOMES THEIR GO-TO CALENDAR FOR THE REST OF THE YEAR CONTINUOUSLY REMINDING THEM OF THE FAIRTAX.

The 2017 FAIRtax℠ monthly pocket/purse planner has the following information on the cover:

AMERICA’S BIG SOLUTION

FAIRtax – REAL TAX REFORM

GROWS THE ECONOMY/CREATES JOBS

VISIT: BIGSOLUTION.ORG

RESEARCH: FAIRTAX.ORG

We are offering these new 2017 pocket planners in packs of 10 units for one dollar. Order as many packs as you need; Don’t be disappointed, order your supply today! Inventory is running low; first-come-first serve.

Also, you will find many other promotional specials when you visit your FAIRtax℠ Store.

Click here to visit the FAIRtax℠ Store.

Thank You For Opening The FAIRtax Chronicles, Our Sponsored Mailings

We plan to do several of these mailings each month. If you take a minute to open the sponsored emails and click through to the website, you are making an in kind contribution to AFFT. It is not required to actually make a purchase, but your minute of time will ensure that AFFT is paid ever larger amounts from people paying for us to send their offers to our supporters.

Again, we are making every effort to ensure that we work with only reputable companies. If you feel that any FAIRtax-sponsored email is objectionable, please email us at info@fairtax.org and tell us why. You can also opt to not receive these sponsored email messages but still receive FAIRtax emails.

Thank you for staying FAIRtax strong!