In all the musings about tax reform, an often overlooked question is “What is the fundamental purpose of our tax system?" It is not to achieve social engineering or favor one form of business organization over another. The fundamental purpose of a tax system is to simply raise revenues to fund government. What are the key features of a tax system which determine its ability to raise revenues sufficient to fund the government? In a few words these can be summed up as revenue sufficiency, stability, and efficiency.

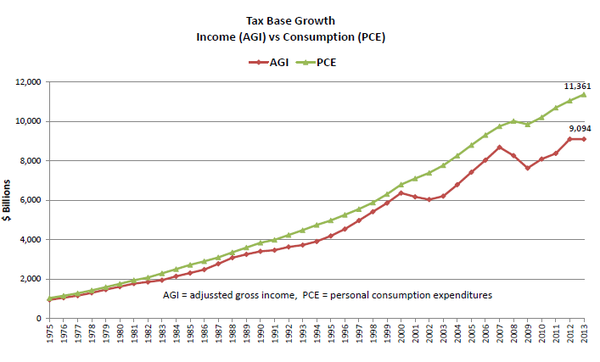

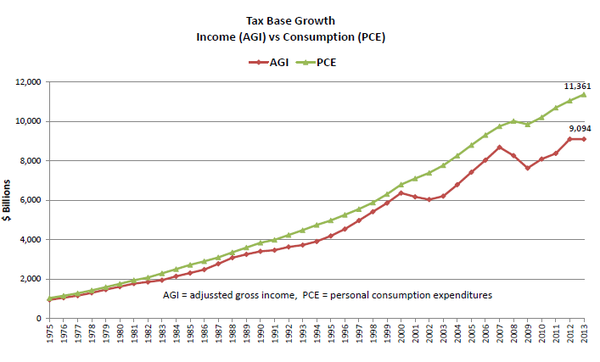

Sufficiency. The tax system must be capable of generating revenues sufficient to fund the government over an extended period of time. Achieving this requires a broad tax base. A tax on consumption would have a much broader base than our current tax on income. The chart below compares the income tax base (as measured by total adjusted gross income reported by the IRS) to the consumption tax base (as measured by personal consumption expenditures) over several decades.

Throughout the entire data range (1975 to 2013), total personal consumption expenditures (PCE) exceeds adjusted gross income (AGI), and significantly so since 2000. In 2013, PCE is 11,361 billion compared to an AGI of 9,094, a difference of 25%. So given an equivalent tax rate, a consumption-based tax would yield 25% more revenue than an income-based tax.

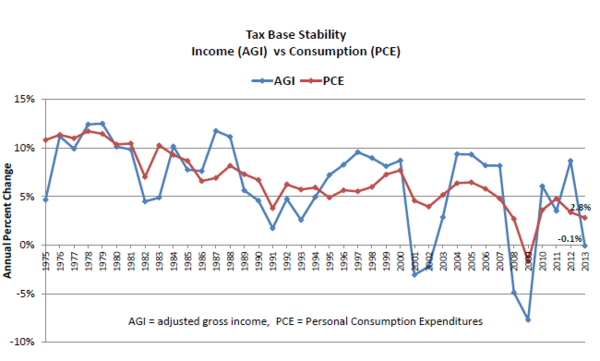

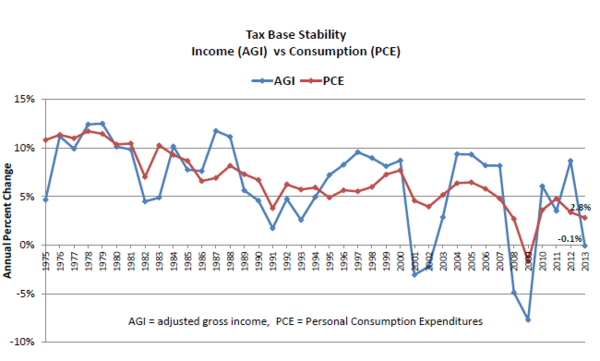

Stability. A revenue system must not be subject to large swings in revenue growth in response to changing economic conditions. The Ideal would be moderate and predictable annual revenue growth rather than a tax system that fluctuates significantly in periods of good economic times and in periods of economic downturns.

The following chart compares the annual growth rate or percent change in PCE compared to AGI. We can make two observations from this chart: (1) AGI is much less stable than PCE. The annual percent change in the tax base ranges from a 12.5% increase in 1979 to a 7.7% decrease in 2009 from the prior year. While PCE growth from year to year does fluctuate, annual percent changes are much lower, ranging from an 11.7% increase in 1978 to a 1.7% decrease in 2009.

Visually you can observe that the peaks and valleys are smaller in the PCE line than in the AGI line. In 2009, AGI dropped by 7.7% but PCE dropped by only 1.7%. Over almost four decades, this was the only year of negative change for PCE; whereas AGI has experience negative growth rates five times (2001, 2002, 2008, 2009, and 2013).

Efficiency: The tax system generates sufficient revenues while minimizing the waste of resources such as physical materials, energy and time employed to administer and enforce the tax system. In other words, the tax system should raise sufficient revenues while minimizing the costs of individuals and businesses to comply with the tax and the cost to government of administering the tax.

The IRS likes to boast that it administers and enforces a tax system that brings in $3.2 trillion in revenues at a cost of only $11.4 billion or 35 cents per $100 of revenue. It is typical of government, however, to ignore the $600+ billion spent by individuals and businesses in the private sector who pick up the tab for 98% of total compliance costs. The FAIRtax would decrease total compliance costs by 90% by making the tax system simple, transparent and by reducing the number of tax filers by at least 80% from 163 million to about 25 million.

The FAIRtax: a tax system that generates sufficient revenues in a cost effective manner while improving revenue stability.

Sufficiency. The tax system must be capable of generating revenues sufficient to fund the government over an extended period of time. Achieving this requires a broad tax base. A tax on consumption would have a much broader base than our current tax on income. The chart below compares the income tax base (as measured by total adjusted gross income reported by the IRS) to the consumption tax base (as measured by personal consumption expenditures) over several decades.

Throughout the entire data range (1975 to 2013), total personal consumption expenditures (PCE) exceeds adjusted gross income (AGI), and significantly so since 2000. In 2013, PCE is 11,361 billion compared to an AGI of 9,094, a difference of 25%. So given an equivalent tax rate, a consumption-based tax would yield 25% more revenue than an income-based tax.

Stability. A revenue system must not be subject to large swings in revenue growth in response to changing economic conditions. The Ideal would be moderate and predictable annual revenue growth rather than a tax system that fluctuates significantly in periods of good economic times and in periods of economic downturns.

The following chart compares the annual growth rate or percent change in PCE compared to AGI. We can make two observations from this chart: (1) AGI is much less stable than PCE. The annual percent change in the tax base ranges from a 12.5% increase in 1979 to a 7.7% decrease in 2009 from the prior year. While PCE growth from year to year does fluctuate, annual percent changes are much lower, ranging from an 11.7% increase in 1978 to a 1.7% decrease in 2009.

Visually you can observe that the peaks and valleys are smaller in the PCE line than in the AGI line. In 2009, AGI dropped by 7.7% but PCE dropped by only 1.7%. Over almost four decades, this was the only year of negative change for PCE; whereas AGI has experience negative growth rates five times (2001, 2002, 2008, 2009, and 2013).

Efficiency: The tax system generates sufficient revenues while minimizing the waste of resources such as physical materials, energy and time employed to administer and enforce the tax system. In other words, the tax system should raise sufficient revenues while minimizing the costs of individuals and businesses to comply with the tax and the cost to government of administering the tax.

The IRS likes to boast that it administers and enforces a tax system that brings in $3.2 trillion in revenues at a cost of only $11.4 billion or 35 cents per $100 of revenue. It is typical of government, however, to ignore the $600+ billion spent by individuals and businesses in the private sector who pick up the tab for 98% of total compliance costs. The FAIRtax would decrease total compliance costs by 90% by making the tax system simple, transparent and by reducing the number of tax filers by at least 80% from 163 million to about 25 million.

The FAIRtax: a tax system that generates sufficient revenues in a cost effective manner while improving revenue stability.